USDT Adoption Surges in Bolivia Fueled by Tether and Banks

- Lyla Velez

- June 7, 2025

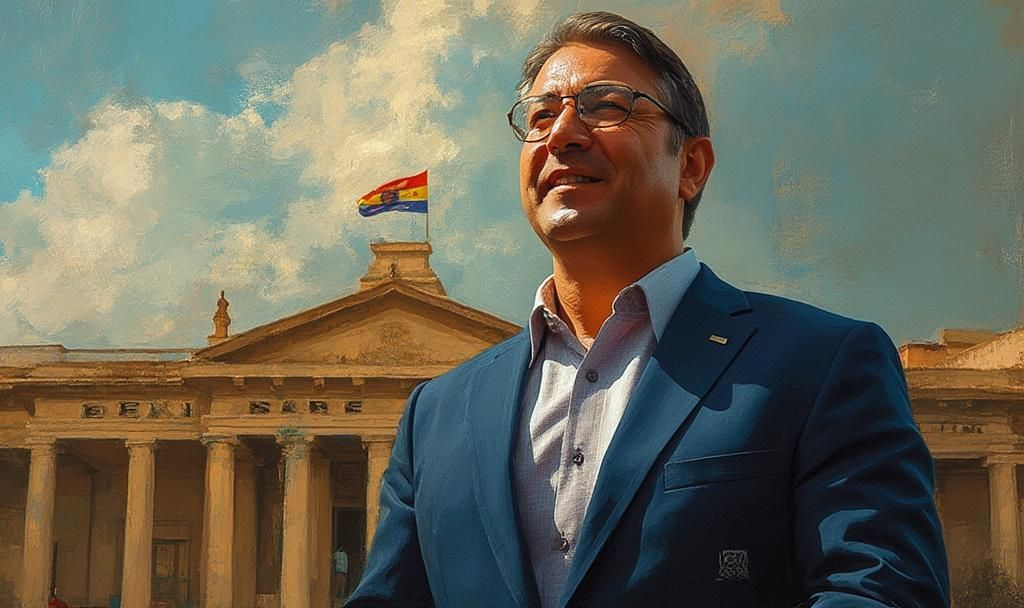

- Paolo Ardoino discusses USDT’s rising use in Bolivia.

- Bolivia’s regulatory shift boosts stablecoin acceptance.

- Banks support digital dollars amid currency concerns.

Paolo Ardoino, Tether’s CEO, announced the widespread adoption of USDT in Bolivia on June 7, 2025, indicating a growing trend in digital currency usage.

Tether’s USDT adoption in Bolivia marks a pivotal moment, highlighting stablecoin’s role in providing financial stability amid local currency volatility.

Bolivia is witnessing tremendous growth in stablecoin usage, particularly USDT, amidst local economic challenges. Paolo Ardoino shared images from Bolivia showcasing products priced in USDT, emphasizing real-world adoption.

This marks a significant shift in how citizens engage with digital currencies for everyday commerce.

Banco Bisa, a major Bolivian financial institution, has facilitated this transition by introducing stablecoin custody services. This move underscores increasing institutional interest and helps bolster confidence among users. The regulatory environment, while still not endorsing cryptocurrencies as legal tender, supports regulated transactions of virtual assets like USDT. The Bolivian Central Bank stated, “Board Resolution N°082/2024 repealed prior crypto bans, permitting regulated virtual asset transactions and stablecoin custody services for banks like Banco Bisa.”

The immediate impacts of USDT adoption are profound, affecting both consumers and businesses in Bolivia. With stablecoin acceptance, individuals can now shield themselves from significant local currency fluctuations. This shift is spurred by the search for more stable financial solutions.

Financially, USDT’s market cap continues to expand, inching beyond $112 billion. Politically, it reflects a shift in Bolivia’s regulatory stance since the 2024 reversal of the prior ban. Socially, the adoption serves as a testament to cryptocurrencies gaining a foothold in economies with fragile currencies.

Insights into potential outcomes show a heightened role for stablecoins in Bolivia’s financial ecosystem. The regulatory support hints at broader adoption, potentially attracting further institutional collaborations. The integration of digital currencies in commerce may set a model for other countries facing similar monetary instability.

Paolo Ardoino stated, “Photos shared from Bolivia show real-world adoption of USDT: products priced in USDT, shops accepting digital dollars. This is not just about crypto—it’s about financial stability for people facing unstable local currencies. Stablecoins are changing daily commerce in places with challenging economies.“

| Disclaimer: The content on nftenex.com is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |