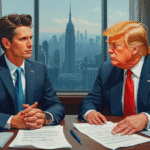

Eric and Donald Trump Jr.’s $1.5B WLFI DeFi Deal Boosts ALT5

- Lyla Velez

- August 14, 2025

- Business

- 0 Comments

- Trump brothers lead $1.5B DeFi deal with ALT5 Sigma.

- WLFI tokens integrated into ALT5 treasury.

- Significant market activity prompted by the partnership.

The deal signifies a landmark moment in DeFi and stands to change the dynamics of institutional cryptocurrency involvement. The direct offering mirrors Michael Saylor’s crypto treasury strategies.

The Trump brothers, co-founders of World Liberty Financial, have led their latest venture with the integration of WLFI tokens into ALT5 Sigma’s treasury. Eric Trump, who also serves as chief strategy officer at American Bitcoin, and Donald Trump Jr., an active participant in crypto trading, bring substantial experience to this venture. Both joined the board of ALT5 Sigma as part of this collaboration, reinforcing their commitment to expanding WLFI’s market presence and strategic influence in the DeFi sector.

The incorporation of WLFI tokens into ALT5 Sigma has resulted in increased stock value and activity. The $750 million allocation for WLFI token purchase secures a significant portion of the token’s supply, while another $750 million supports treasury operations and liquidity. This aligns with strategic approaches observed in institutional markets, characterized by substantial secondary market engagement for WLFI tokens.

“One small step for mankind, one giant leap for WLFI.” — Eric Trump, Co-Founder, World Liberty Financial (WLFI)

There is a notable financial impact from the Trumps’ decision, reflecting their established history in blockchain ventures. The market has responded positively, echoing optimism within cryptocurrency communities. The transaction aligns with regulatory standards, suggesting institutional legitimacy. Financial impacts could be broad-reaching, prompting similar treasuries and DeFi protocols to explore public equity exposure. The move might also encourage regulatory scrutiny, potentially setting new precedents in crypto governance.

Industry analysts see potential in evolving treasury models as a result of this strategic action. The move, marked by significant parallels to public company crypto exposure strategies, could spark shifts in regulatory frameworks and technological applications within the sector. Future developments may further integrate governance tokens into mainstream financial practices.

| Disclaimer: The content on nftenex.com is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |