Top-Rated Bitcoin Mining Firms in the Market: Operations, Expansion Plans, and Challenges

- Tristan Cole

- September 29, 2025

- Mining

- 0 Comments

Top-rated Bitcoin mining firms are recognized for their ability to combine financial strength with efficient energy strategies. These companies influence not only the production of Bitcoin but also the direction of the global mining industry. Investors seeking exposure to this sector must evaluate their scale, technology, and ability to manage risks.

Quick Comparison Table

| Firm | Share Price (USD) | Operational Hashrate (EH/s) | Market Cap (Billion $) | Expansion Target |

|---|---|---|---|---|

| Iris Energy (IREN) | 46.29 | ~7 | 12.58 | 10 EH/s, ESG certified |

| Riot Blockchain | 16.74 | ~10 | 6.18 | 15 EH/s by 2026 |

| Marathon Digital | 16.07 | ~9 | 5.95 | 12 EH/s, -30% energy costs |

| Core Scientific | 16.84 | ~8.5 | 5.14 | 11 EH/s, expand hosting |

| Cipher Mining | 11.66 | ~6 | 4.58 | 10 EH/s, 70% renewable use |

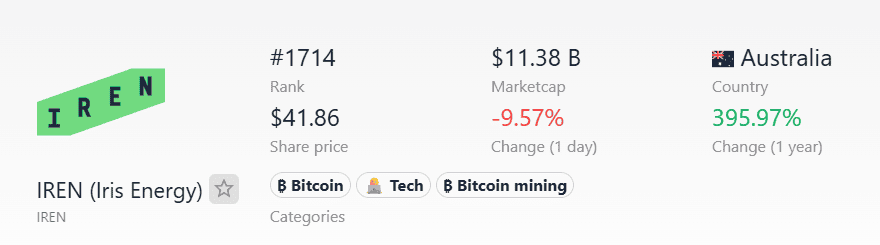

1. Iris Energy: The Benchmark for Sustainability

Iris Energy, trading at $46.29 with a market value of $12.58 billion, sets the standard for clean Bitcoin mining. The company runs its operations entirely on hydropower, making it carbon neutral. By using immersion cooling technology, Iris lowers power consumption while extending hardware lifespan.

Its 7 EH/s capacity translates to 3,500–4,000 BTC mined annually. Despite a slight daily dip, the stock’s monthly surge of nearly 30% demonstrates investor confidence. With an expansion goal of 10 EH/s and full ESG compliance, Iris aims to remain the most sustainable large-scale miner.

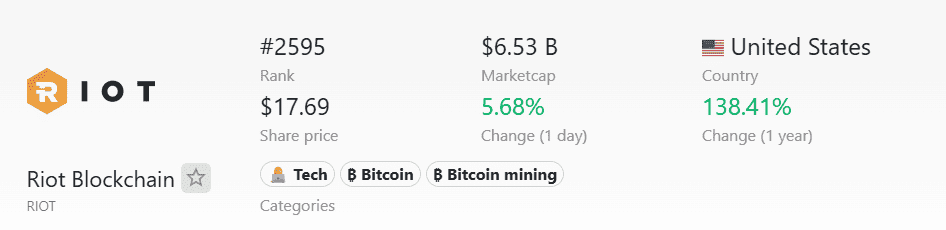

2. Riot Blockchain: Leveraging the Texas Advantage

Riot Blockchain, priced at $16.74 per share and valued at $6.18 billion, dominates through its Texas operations. By participating in load-balancing programs, Riot not only cuts costs but also generates grid-related revenues.

Its ~10 EH/s hashrate supports the production of over 5,000 BTC per year. Though the stock recently fell 6.95%, it gained nearly 20% across the last month. The company targets 15 EH/s by 2026, leveraging Texas’ cheap and flexible power infrastructure to maintain a cost-efficient edge in the global market.

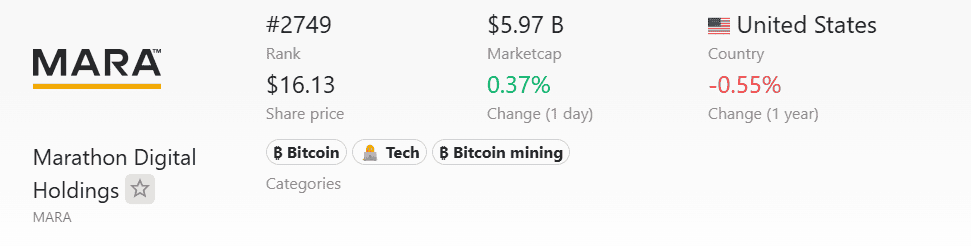

3. Marathon Digital: Rapid Expansion in Focus

Marathon Digital, with shares at $16.07 and a $5.95 billion market cap, is known for aggressive scaling.Its facilities across the U.S. are powered by a combination of wind and natural gas. Marathon invests in state-of-the-art ASICs, improving efficiency and output.

With a current hashrate of ~9 EH/s, it produces more than 4,000 BTC annually. Stock performance shows volatility, down 8.9% in a day but up 25% in a month. The firm’s roadmap includes reaching 12 EH/s while cutting per-BTC energy costs by 30%, strengthening its position as a growth-driven miner.

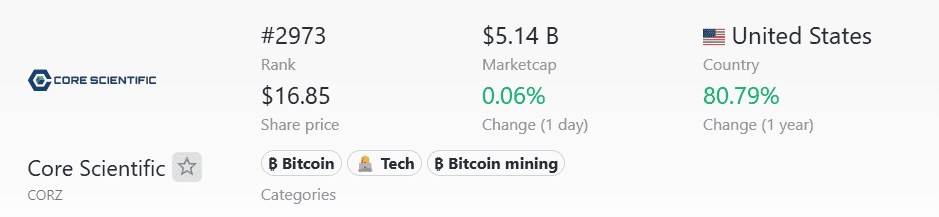

4. Core Scientific: Balancing Mining and Hosting

Core Scientific, with a $5.14 billion valuation and shares trading at $16.84, offers a hybrid business model. In addition to mining Bitcoin, it provides hosting services for third-party clients, making revenue less dependent on Bitcoin’s price cycles. Its ~8.5 EH/s hashrate yields over 3,500 BTC yearly.

While its stock only dipped 1% in the latest session, the company continues to demonstrate stability. Plans include increasing capacity to 11 EH/s and expanding hosting operations. Transparent ESG disclosures also make Core Scientific attractive to institutional investors.

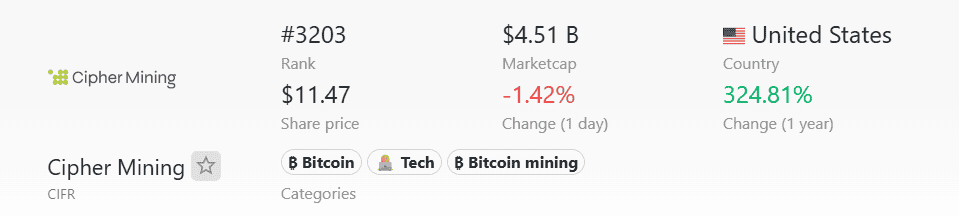

5. Cipher Mining: Emerging with Renewable Growth

Cipher Mining, priced at $11.66 per share with a $4.58 billion valuation, is the smallest but fastest-rising contender. Its modular mining facilities in Texas and Ohio primarily use renewable wind and solar power. This setup allows the company to expand flexibly based on market conditions.

With ~6 EH/s, Cipher mines roughly 2,000 BTC per year. While its stock dropped 17.54% in a single day, the long-term plan is to reach 10 EH/s by 2026 while keeping renewable energy usage at 70%. This combination makes Cipher both risky and forward-looking.

Risk and Regulatory Outlook

Mining firms face risks from both Bitcoin’s volatility and regulatory changes. When Bitcoin prices collapse, revenue can fall by as much as 80%. Simultaneously, stricter energy and tax rules in regions like the U.S. and Europe add cost pressures.

Supply chain disruptions and hardware shortages can also delay expansions. Investors need to recognize that while upside potential in bull markets is enormous, downside risks are equally severe, requiring careful entry timing.

Conclusion

Iris, Riot, Marathon, Core Scientific, and Cipher define the mining landscape through different paths sustainability, cost optimization, diversification, or renewable scaling. They illustrate how miners are adapting to the new era of crypto infrastructure. For investors, they offer compelling opportunities, but only those ready for high-risk, high-reward scenarios should engage.

FAQs

Q1. How do mining companies achieve top-rated status in the industry?

Top-rated firms typically combine large hashrates, efficient power management, and consistent financial growth. Their scale gives them an advantage in reducing per-BTC production costs.

Q2. What role does location play in mining profitability?

Location matters because energy prices vary worldwide. Countries or regions with cheap electricity and flexible energy programs allow miners to operate more competitively.

Q3. Can diversification protect mining firms from Bitcoin volatility?

Yes. Some companies diversify by offering hosting services, using mixed energy portfolios, or expanding into different regions. These strategies provide more stable revenue streams.

Q4. How do investors evaluate mining companies compared to other tech firms?

Unlike traditional tech companies, miners’ revenue is tied directly to Bitcoin’s market price. Investors should examine financial ratios but also track BTC price cycles and energy contracts.

| Disclaimer: The content on nftenex.com is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |