Bhutan’s Bitcoin Reserves Reach 40% of GDP

- Lyla Velez

- August 18, 2025

- News

- 0 Comments

- Bhutan’s bitcoin reserves make up 40% of GDP.

- Hydropower fuels sustainable mining strategy.

- BTC reserves used for fiscal cushioning.

Bhutan’s state-owned Druk Holding & Investments (DHI) has expanded its national bitcoin reserves to approximately 40% of the country’s GDP, amounting to around $1.3 billion, underscoring the country’s unique approach to cryptocurrency mining.

The achievement highlights Bhutan’s strategic use of cryptocurrency as a national asset, reducing reliance on traditional revenue streams. The response from financial markets underscores potential shifts in sovereign digital asset management.

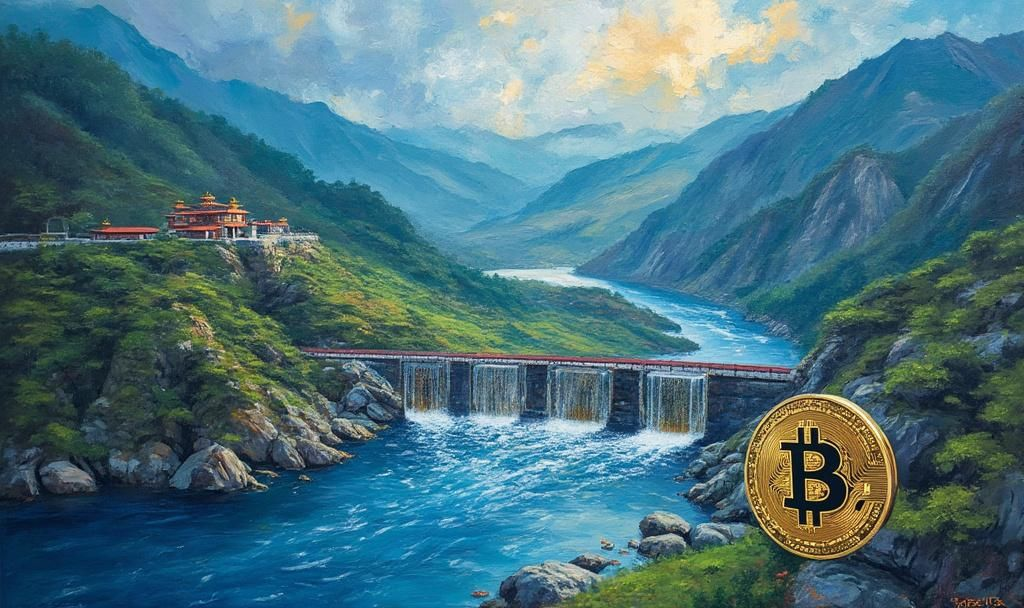

The Himalayan Kingdom of Bhutan

The Himalayan Kingdom of Bhutan has become the third-largest sovereign holder of bitcoin, reflecting a significant shift towards cryptocurrency. The state-owned Druk Holding & Investments (DHI) manages these reserves, reinforced by the sustainable use of hydropower.

Bhutan initiated its state-directed bitcoin mining operations in 2019, integrating these efforts as a core national asset strategy. Druk Holding & Investments (DHI) stated,

“We have pursued state-directed digital asset accumulation as part of a broader national economic strategy.”

Driven by DHI and partners like Bitdeer, Bhutan leverages hydropower for green mining, substantially bolstering its bitcoin reserves.

Fiscal Strategy and Mining Operations

With the bitcoin supporting government expenditures such as increased civil servant salaries, Bhutan offers a fiscal response to declining tourism income. Former Prime Minister Tshering Tobgay mentioned that “a doubling of civil servants’ salaries” can be financed through bitcoin sales. source.

The state has adopted a long-term asset strategy, focusing solely on bitcoin over altcoins like Ethereum.

Environmental Impact and Future Implications

Bhutan’s reliance on hydropower for mining emphasizes minimal environmental impact. As a landmark in sovereign cryptocurrency management, Bhutan’s approach positions the nation as a prominent player, drawing comparisons to The U.S. and China’s bitcoin holdings.

The long-term implications for Bhutan include strengthened fiscal policies and potentially introducing more nuanced regulatory conditions tailored to cryptocurrency. This focus on bitcoin could signal a broader regional shift towards sustainable and strategic digital asset use.

| Disclaimer: The content on nftenex.com is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |