Governor Abbott Signs Bill Protecting Bitcoin Reserve

- Lyla Velez

- June 21, 2025

- Policy

- 0 Comments

- The bill protects a potential state Bitcoin reserve from liquidation.

- State investment hinges on Senate Bill 21’s approval.

- Bitcoin is the only eligible asset currently.

The signing of HB 4488 strengthens Texas’s stance on digital innovation and fiscal resilience, awaiting further legislative action to operationalize investments.

The Legislative Move

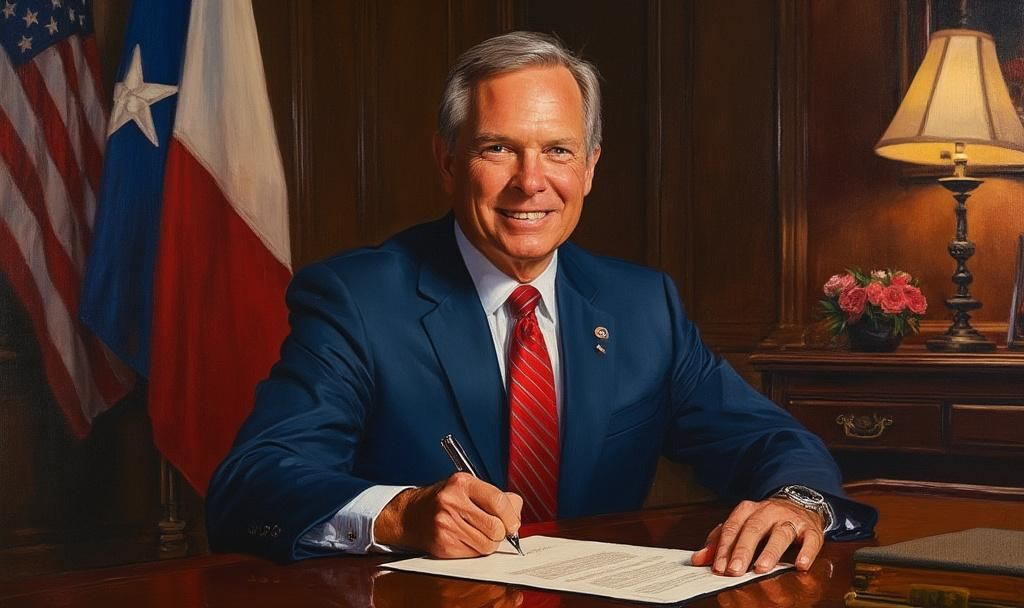

Governor Greg Abbott has officially endorsed HB 4488, a move to protect a prospective Texas Bitcoin reserve. With the bill signed into law, Texas reinforces its commitment to digital currencies and innovation. “I’m proud to support a bill that protects Texas investments and positions our state as a national leader in digital innovation,” Abbott stated.

Notable figures like State Rep. Giovanni Capriglione advocated for the bill, emphasizing the importance of digital innovation as a financial tool. Capriglione’s leadership in promoting fiscal and technological advancements plays a pivotal role.

“This bill embraces digital innovation… a financial tool aimed at strengthening the state’s fiscal resilience.” — Giovanni Capriglione, State Representative, Texas

Current and Future Impacts

The bill currently safeguards Bitcoin, the only cryptocurrency eligible under the present framework. If Senate Bill 21 is enacted, it would authorize state investment, solidifying the reserve’s legal and financial foundation.

No immediate changes in transaction volumes or investment patterns have been observed. The reserve’s potential future establishment could alter Texas’s financial strategies.

With SB 21 pending approval, the focus remains on how financial, regulatory, or technological advancements could unfold. If enacted, the legislation will likely influence governmental and financial sectors significantly.

| Disclaimer: The content on nftenex.com is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |